Transcript

Hello, everybody, and thanks for taking the time to tune in to this webinar here today. Just to start things off a little bit unconventionally, with something topical. So today is Singles Day, I'm not entirely sure that everybody knows what this is, but it's the 11th of November. And it's the biggest day of e-commerce online annually. Last year on one day alone, Alibaba did $38 billion in sales, okay, and the entire number for China according to the LA Times is about $60 billion.

Okay, so here on the west, we're very focused on Black Friday as being the biggest day of the year, but to put things in perspective. Last year, Black Friday and US was 1/8 of the revenue done in China on a single day. Okay. So the message here this morning is basically the things are happening that you may not even be aware of that are much, much larger than then you know, what we perceive to be the normal right now. And you might be asking, what does this have to do with wealth management, really, the context here, and the message for the morning is that COVID-19 is changing everything, I believe that in years to come, they will be referring to 2020 in the same tones that they refer to the Industrial Revolution, or the impact of cheap air travel. And in my perspective, digital COVID-19 is a digital meteorite, okay. And it's absolutely disrupting traditional businesses, there will be massive winners, but there will also unfortunately be losers. And it's necessary the businesses grasp this reality and transform rapidly.

Forbes has estimated that e-commerce online commerce alone in the US jumped 50% in April (2020). Okay, and you can see the metrics here are absolutely profound. And if we look at statistical metrics, okay, this is the quarterly share of e commerce of total US retail sales for the last, you know, 10 years. And basically, the level of growth in q2, this year was 16 times faster than traditional. Okay, so we've achieved as much growth in a quarter now because a COVID, as was achieved in the past 16 quarters. Okay, so this is quite stark. And really, it's an imperative call to action, the businesses need to actually embrace this reality and transform rapidly. Okay, so the digital new normal is certainly an omnichannel, normal. And if you're wondering what omnichannel is, it's every touchpoint that your customer experiences, whether they're discovering your service or interacting with your business.

So it could be something they do on mobile, it could be something they hear or do on social networking platforms, it could be something they do on their desktop, but could be meeting you as an influencer, face to face. So it's a massively complex journey, with multiple, multiple touchpoints.

And again, just to narrow the lens very briefly, if you just look at it through the lens of a child being smartphones, mobile, or desktop, in 2019 58% of search, traffic happened on mobile, okay, but 37% of purchases happened. If we look at desktop, the inverse is true. less traffic, but actually more purchases made on desktop. So impulse purchases are happening on mobile, considered reflective purchases are happening on desktop.

The Customer Journey

So coming back to the context of wealth management and financial industry, the question really is ask is What is your client's journey or your clients experience? Certainly, it's a human journey, okay. They're human beings. At the end of the day, they're people just like you and me. And it's certainly an omni channel journey. So it's likely some sort of a life event, some sort of a trigger. It's a conversation with somebody, a family or friend or a personal influencer, they're clearly searching on Google, they're probably accepting cookies from some of the websites they visit. And suddenly, they're getting frequently targeted on Facebook or other social networking platforms, they do some work on desktop, because this is a very important life decision that you make, probably, once they're contacting you, they might talk to an agent or an advisor, they might not like the conversation, they'll go back, they'll check the reviews online, they'll try some competitors, they might meet you in person, and then they may end up going with the person that their best friend told them that they're using.

The Limitations of Focus Groups

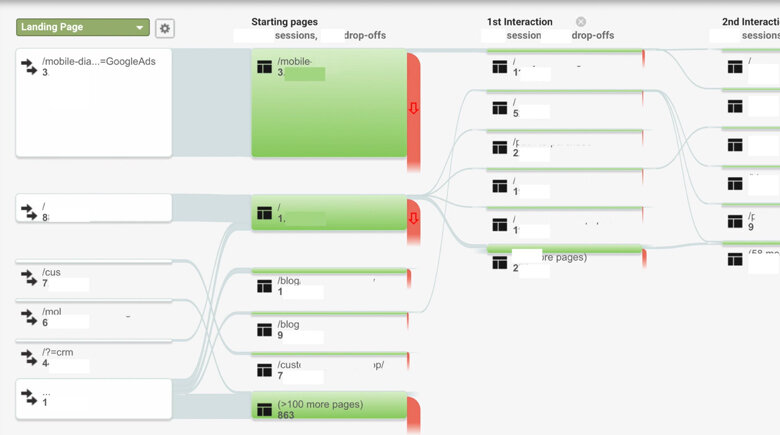

Okay, so crazy, nonlinear, quite erratic journey. And it's impossible to map using traditional research approaches. Okay. So, you know, if you're looking at Google Analytics, you're looking at something that looks like this, you know, massively confusing. I've never been able to figure out these journeys. They tell me really, that I think I have a problem. But I have no clue why you might try to go to focus groups to figure this out. But really in focus groups, what you're doing is you're getting a bunch of strangers into a room with a two way mirror where they're a little bit paranoid about who's on the other side. And in reality, what they're doing is they're talking about a memory of something they may have done months ago, so with post rationalized, it's, you know, they may not be telling you the truth because they don't want to talk in front of a bunch to strangers. And under all the context, so you know, this is some extra data. But really, it's not personal, it's not private, not intimate and they're really not telling you what they're thinking in the moment. And what really influences their decision and in reality, they're probably being polite. Okay? So what we do is we kind of fix this problem.

Mobile Ethnography Platform

So Indeemo is a mobile ethnography platform. And what we do is we help you do research remotely, we help you connect with your clients or your customers, your potential customers. So you can research, their needs and their behaviors, their aspirations. You can do exploratory, foundational, qualitative research with us, we can help you map their journeys, okay. And we can start to help you understand their customer experience when they're engaging with your service or your offering. We do this for many different brands, across many different sectors across many different demographics, everything from, eight year old kids talking about what they watch on TV, and what apps they use to 70 year old patients talking about quality of health care.

Research We Support

How we can support you is in any of the following functions within your business. So you probably have a marketing team, our consumer insights team, we can help them do foundational researcher, you know, augment their segmentations, you certainly have a product team and product managers or user experience designers and researchers, we help them do user research remotely, whether that's usability, our human base research, we help you map journeys, and whether that journey is a path the purchase of a potential customer or client, or the journey and experience of an existing customer or client. So these are all the actors we would engage with, within your organization to help you improve your understanding of your customers and clients. You might be wondering, you know, who do you need to understand? So the various personas in the orbit of wealth management are probably, you know, retirees are somebody nearing retirement or somebody's thinking about retirement in their families, right? They could be the parents, or they could be the children, they could be the next generation of customers. They could be the advisors in your network, or brokers, they might be your employees, you might be trying to understand your employee engagement, your employee experience. So these are all the different actors in the orbit of wealth management, that we can help you research.

How we Help

You might be wondering, what can we help you do? You know, you, you certainly want to understand people's goals, their aspirations, their fears, around retirements, okay, you need to build out your customer personas and your segmentations you need to validate your segmentations you might need to understand how people arrive at your inbox. Okay, what is their purchase journey up to the point where they actually contact you and field an inquiry? You might be wondering, what is their user experience on your mobile websites or actually on your desktop websites. Okay. You certainly want to understand your customer experience in terms of how do they engage with you? What's their experience in terms of collateral information, the reports you send them, and their interactions with the people in your organization that support them? Okay, how do you find them? Typically, you would either reach into your CRM and invite some of your existing clients to take part. Or you may engage what we call a qualitative recruiter to go to market. And basically screen and put out surveys there to screen potential research participants to match your customer persona. So you may screen them by age and location, are they retiring? Are they near retirement? Are they retired? You may have another demographic about the children of potential retirees and the recipients of wealth transfer, you might want to find them.

So a qualitative recruiter will help you do this. And what they do is basically they will offer these research participants incentives to take part, so we can work with you or the qualitative researcher can work with you. And they can advise you as to how much you should pay these research participants to take part in, mobile ethnography, remote qualitative research studies, to give you the information you need.

How it Works - Our App

When you find these participants, and when they register, what they're doing is they're using our app, the Indeemo app. And essentially, this is a bit like a private one to one Facebook between a researcher and the research participants. And what they're doing the participants your potential clients or existing clients are doing, they're keeping an interactive digital diary of everything they're doing in relation to your research topic. So it could be screenshots of websites they visit, it could be pictures of you know, them standing outside your offices, it could be notes of them writing about their thoughts on a particular topic. It could be video where they, emote about their aspirations or fears about retirement, it could be a mobile screen recording, where they're, showing you how they're stumbling around Google or something around your websites, trying to figure out information on a/ who they should be talking to and b/ how to reach these people and c/ what is your service offering typically works on smartphones, so it's always on you get to remotely walk in their shoes. It works on iPhone, and it works on Android.

Mobile Screen Recording

Okay, one particular capability we have which is really, really powerful is what we call mobile screen recording. So with mobile screen recording, what we can do is we can task, your research participants, your potential clients or existing clients to To start the screen recording using in demo, and then go to Google and do a search. Now we muted the audio on this video just for this presentation. But essentially what this is, is a video of a potential client browsing Google for the first time to figure out about wealth management firms in the UK. And what you're starting to see here is the scroll scrolling slowly gone a good way down the page, it didn't engage with the advertisement for HL, you know, they went straight to the Financial Times it's a trusted source, very old website, not secure. Browse around here a little bit clearly and didn't get the information, they need to jump back up, jump back up again. And then now what they're doing is they're going to the Business Insider, another trusted source. And they're kind of stumbling around here. So if you're looking at, again, going back to that metaphor of Google Analytics, what you're seeing on Google Analytics, or any other new quantitative analytical package is just these kinds of Tableau visualizations of journeys. That basically tells you what you already know you have a problem. You're not converting enough, but you have no clue why. And really, what we're doing here with screen recording is this layer of multimedia video that shows you the user experience or the customer experience of anybody trying to figure out if they need to speak to you or not. And what's interesting on this page clearly, Hargreaves Lansdowne and St. James's place are, are quite strong. If we watch this here for a couple of seconds, actually, I think what came out is this concept, you can see this participant actually looking at Robo advice. So this is clearly a new term to them. They're highlighting that they're looking that up. And now they're going out basically searching Google robo advisor to jumping into Wikipedia, and they go from there. And the end of this journey, really, I think, is this particular research participant ended up on Betterment, one of the FinTech startups, that seems to be disrupting the space.

Insights Dashboard

Okay, so incredibly powerful at helping you understand how people are engaging with you digitally, right? All that information is collated and seamlessly uploaded to an insights dashboard that looks like Pinterest, works like a private secure one to one Facebook. So your researchers who might be external consultants or internal team members all get to see all this information with powerful filters and a beautiful interface. And they can see basically, data from your research participants in real time as being uploaded.

If they've got a question to ask, they can comment on the post of what you participants uploaded. And that sends out a push notification to the research participant, they swipe it, they can reply. So you can now have this dialogue that feels like a one to one private Facebook interaction with your potential clients. And in this way, basically, you're getting to probe what they're doing in the moment. So again, going back to the focus group mechanic, the focus group is post rationalized where they're recalling memories, this mobile ethnography Indeemo approach basically, is in the moment where you get to interact with them now. So the end behavior is instant, it's in the moment - it is very contextual. And their answers are fresh, because they're literally doing it right now.

Journey Mapping

What we can also do as well as we can, in customer experience, or user experience, audits and journey mapping studies, we can basically help you graph the highs and lows of their journey through any journey that they go on. So this might be, you know, browsing online for advice, during an initial call, filling out all those forms doing an initial review signing up. Overall, you know, talking about the overall experience, this is quite simplistic, sure is much more complex than this. But essentially, we can show you the highs and lows of your clients' experience. And think about this as a kind of an in the moment, contextual Net Promoter Score, where not only do they rate their experience when they're experiencing us, but they also give you a video or a screen recording that allows you to get behind that touch point and understand why it's a positive or negative experience. So this is incredibly powerful, like quantifying experiences and also proving why the experience is the way it is and showing you how, what you need to change in order to improve us.

No Need for InPerson Focus Groups

The power of this approach is to kind of circle back on this is it remote, so you can do this remotely. Now you don't have to bring somebody into a focus group facility, you don't have to fly somebody somewhere to meet someone. It can all be done over mobile.

No Post Rationalization

Secondly, it's in the moment. So it's not post rationalized. It's actually happening right now. So if they're on your website and they're struggling, that's the truth that you need to embrace. If they're telling you that they interacted with one of your agencies, you had a negative experience. And they do that two minutes after the call. That is the proof that you need to act.

Walk in Their Shoes For a Longer Duration

It's longitudinal as well. So it's not just a 90 minute interview at one point in time. A study in wealth management or in the financial services space could go on for weeks. So you get to walk in their shoes longitudinally for weeks. You get to go on the journey with them. Virtually, and basically, they get to show you over time, organically and authentically what they're really doing, again, in relation to any research topic, you might get them to do.

Some TakeAways

A couple of thought provokers. So, you know, it's traditionally an industry of referrals and face to face meetings and handshakes. You know, you need to be digital.

If you're not above the fold on Google, you probably don't exist for the next generation of clients coming your way. Chances are, they're entrepreneurs, they may not be coming from traditional family networks. They might not even know you exist. So they're stumbling around Google, and you need to be present here. Okay, not all searches are the same. So if somebody is buying toothpaste two for one doesn't make that purchase in a split second, if they're, if they're purchasing a mortgage, or trying to find a pension provider of financial planning, they may take months, okay, so search can be fast, or search can be slow. And certainly in the financial space, it is slow, and it's certainly omni channel.

If they're on mobile, and if they're searching your competitors, or just the next tab on a browser, or they are a double tap away? So we routinely see consumers multi banking, we see them multi shopping, you may be shopping on Tesco, and they may be shopping on Amazon and buying something on Amazon because it's 10 cents cheaper. And you know what delivery is free. Okay, so the metaphor of the double tap is really the fact that geography is history, so you're not meeting face to face, you're not geographically constrained, you can jump on a website, they can compare you side by side with your competitors. And they make split second decisions. If you look at this through Google Analytics, this is just churn, they just abandoned, you know where they've gone. If you do this using screen recording, we can show you that they've actually double tapped and they've moved to a competitor.

So it's that layer of video proof that goes on top of your analytics to shine the light on the blind spots in your data.

What Does the Next Generation Client Journey Look Like?

To be honest, I think Donald Rumsfeld put it best, you know, none of us really know, we may have our hypotheses, we may have our internal theories. But until we actually confront reality by doing research with existing clients, or potential clients, you know, we're in a data vacuum. So it's time to get out of the office, it's time to fire up new research to figure out how your client personas have changed as a result of COVID.

We're in a new normal, so you need a new approach, or the old ways of doing things, surveys, focus groups, you know, retire, relying on big data alone, they don't work anymore, you need a new approach, and you need something that's contextual, you need something that's in the moment, very human centric, and brought to life in video.

This graph is profound, you know, the rate of change in e-commerce alone is 16 times faster than what it was last year. So this is an urgent call to action for every business on the planet. It's time for us basically to challenge every historical assumption hypothesis that we have about our customers about our business about everything to do with it. So the world has been turned upside down. Yield, as I say, this is the digital meteorite. And it's time for you to fire up some research to get some new, fresh, real life data back into the decision making process in your business. Certainly, for sure, you know, you don't know what you don't know, go back to Donald Rumsfeld. But your customers will show you, and again, you're going to rely on what they tell you in front of a bunch of strangers, are you actually going to rely on the video that they're recording when they're sitting on the sofa at 10pm at night, you know, talking about their fears about their financial stability in the future, and basically how you can solve that, okay, so nothing brings consumer needs and consumer behaviors to life like video, and actually nothing beats video for getting leadership teams to act on these insights.

So that's a quick overview of the power of mobile ethnography and Indeemo in the wealth management space in the financial services industry. I hope it's been useful. My contact details are here on screen would be great if you reach out to us and we'd love to discuss your research requirements and show you how we might be able to support you and support your transition to “the next normal”.

Transcribed by https://otter.ai

Learn more

Blog Recommendation

Case Study Recommendation

Get started with Indeemo and transform your approach to qualitative research

Connect with the humans that matter to you, in the moments that matter to them and generate rich, actionable insights as a result .