Mobile Ethnography White Paper

Learn how Mobile Ethnography can supplement your research projects and generate richer contextual insights for your brands.

We’re seeing a growing amount of Market Research, UX Research, CX and Service Design professionals looking for innovative solutions to conduct Exploratory Research (aka Discovery Research or Generative Research) with both colleagues and B2B Customer Personas.

This demand is being driven both from a front stage focus (Brands looking to do B2B Customer Research) and a back stage focus (businesses realising the vital need to do Employee Experience Research).

This post offers practical tips and advice for how you can conduct effective, impactful B2B Customer and Colleague Experience Research.

The go-to method for B2B research is typically a 1-1 interview conducted via Microsoft Teams or Zoom. Most of your target audience have these video applications installed on their workstations and as a result it is a low friction way to do B2B or colleague research.

If this is your preferred method of research, you can leverage Indeemo’s integrations with Microsoft Teams and Zoom to import your recorded interviews into Indeemo where they are transcribed in up to 27 languages and, once transcribed, can be analysed in a fraction of the time using Generative AI prompts.

Click here for more information.

However, given the hybrid nature of work and the fact that most B2B customer personas are incredibly hard to meet in person, Market Researchers and UX Researchers are increasingly leveraging asynchronous, digital first research approaches such as Video Diaries or Mobile Ethnography for B2B Research.

This asynchronous approach is the main focus of this post.

B2B projects now represent approximately 20% of the exploratory research we support. This percentage is growing quarter by quarter, driven mostly by the need for richer, contextual, “human” data to augment existing metrics and analytics.

When we analyzed the uptick in B2B research, the client personas that emerged were:

Technology-driven, data-rich, digital by default brands

Traditional brands on a digital transformation journey.

Healthcare brands seeking to get closer to HCPs

Research teams focused on colleague / employee experience research

Digital by default businesses rarely, if ever, meet their customers face to face. Their primary lens into the lives of their customers is typically an analytics platform, logs or their CRM.

Ironically, although these disruptive businesses have more data than traditional incumbents, and can tell you down to the second how long it takes for customers to convert (or churn), they are blind to the context in which their customers are engaging (or disengaging) and, more critically, they struggle to understand why.

As a heads up, this is a very detailed post - approx 15 min read. Here are the headings in this post so that have an idea of what areas we cover.

How to find the right Respondents

The importance of transparency

B2B research incentives

How to maximise completion rates

Why some over recruitment is necessary

Why you need to give B2B user personas more time than B2C

How to establish trust with participants

Why B2B research participants need to know your “why”

Give them a voice

Why poor engagement can sometimes be a lot of insight

Setting expectations with stakeholders is key

Why playing the long game is critical

Make user research part of your culture

Context is everything

As more and more brick and mortar brands come under digital transformation pressure to disrupt themselves into technology-powered, agile, data-driven organizations, they are unwittingly creating digital distance between their employees and their customers.

It’s now apparent to us that this digital distance commonly creates ‘human data’ blind spots that big data is failing to visualize.

Remote, media-rich, in context, digital ethnography a powerful methodology to help brands illuminate these blind spots by bringing the people behind the analytics to life.

If you’re a Designer or Researcher who is struggling to understand the people behind the pie charts, this post shares some insights and strategies on how this agile, cost effective and scalable methodology can be leveraged to augment your existing insights toolkit.

The first place to start is by finding respondents. Recruitment can make or break your B2B research project.

For B2B clients, there are generally 3 options:

Tap into your CRM

Using a Qual Recruiter

Recruit via Indeemo’s in-platform recruitment solution

There are pros and cons to each approach.

By using a Qual Recruiter to recruit respondents who match your user or customer personas, you are essentially contracting these respondents to engage with your research and complete all of their tasks and assignments. From the very outset, it’s clear to them that they must complete all of their tasks in order to receive their incentive. These respondents are commercially opting in and as a result, your recruiter has a stick (cash!) to chase them to ensure they engage and complete their tasks.

If they fail to engage, they don’t get paid and you get to replace them with alternative respondents if needed. This is clean and easy. Your Recruiter will do all the hard work and will be an active partner in helping your research succeed.

Working with respondents from your own CRM is a different kettle of fish all together.

We believe the most authentic respondents you can recruit are the ones who either signed up to or are paying for your product or service. They are invested in the product, are genuinely seeking value from it and, if you can truly understand their needs and design a product / service that gives them a great experience, revenue growth is inevitable.

However, recruiting customers from your CRM and asking them to be respondents needs to be carefully considered. Typically, the relationship is not as transactional or commercially driven as it might be with a recruited respondent.

For some CRM respondents, this might be the first research they ever take part in. As a result, they may not know or understand the rules of the road as well as a recruited respondent. You certainly won’t be able to push them as hard as a recruited respondent who has essentially contracted with you to do the work you need them to do in order to complete their fieldwork activities.

Consequently, you need to manage the relationship more delicately because in reality, their experience of your research project will also impact their experience of your brand.

It is now possible to recruit B2B respondents via Indeemo’s platform integration with Respondent.io. You can launch a screener in less than 1 hour and, depending on your target audience, should start seeing applicants in 2-6 hours.

For more information, click here.

Finally, it is worth considering a hybrid approach where you recruit Respondents both from your CRM and via a Recruiter / Indeemo’s panel. This will give you the dual perspectives of users and non users. In this scenario, your Recruiter can also manage the relationship with your CRM respondents which leaves the chasing up to them while you get to focus on your research.

Read: The Indeemo Guide to Online Qualitative Research Recruitment

Regardless of which recruitment strategy you pursue, you will need to ensure that you explicitly outline to the respondents what they need to do, how long it will take them to do it and how much they will get paid for partial or total completion of tasks (see my note on gamification or incentives below). This is critical.

Secondly, you will need to ensure you explain to them why you are collecting the data, how it will be used, who will see it and for how long it will be retained.

It’s essential that you explicitly outline this at the start as Respondents will want to know this. If it’s not clear, why would they sign up to take part? The more clarity you can give them on your use of their data, the better.

Finally, in B2B contexts, you need to consider the additional constraints of their employment contracts (if applicable). Is it ok for them to take part in your project and share information with you that relates to their workplace? Depending on your respondents and the organizations they work in, this will need to be considered at the very outset.

Pseudonymization strategies can be a big help here to limit the amount of PII you collect. Our Strategists can point you in the right direction if needed.

If legislation such as HIPAA applies, you will need to take additional measures to anonymize the data. In these scenarios, it’s useful to have an independent Recruiter retained to act as a middleman and essentially create a Chinese wall between you and the Respondent.

Simply put: be as transparent and explicit as you possibly can with the respondents from the very outset. This quickly establishes the rules of engagement and will ensure everyone is on the same page. Doing so will significantly improve the success of your research.

Secondly, when recruiting respondents from your CRM, you will need to incentivize them realistically to ensure you capture their attention and maximize the likelihood of them completing their tasks.

Unlike B2C research, where respondents are typically taking part to earn extra cash and complete tasks in their spare time, usually outside a work environment, B2B ethnographic research projects mostly happen during the working day.

As a result, respondents need to interrupt their work routines in order to complete the tasks that you allocate to them. This competition for their focus requires a strong incentive so they are motivated to not only engage but to complete all of their tasks.

Typically, B2B incentives need to be 2-5x the B2C equivalent. Whereas you might be able to quickly find a cohort of twenty-something Gen Zs who like soy lattes, sourcing a Dental Technician or a Self Employed Accountant is a more difficult task.

So, when you do find them, you need to reward them well AND structure the incentives to maximize the likelihood of them completing their tasks.

To do this, you will need to gamify the payment of incentives so the more they do, the more they will be rewarded.

Structuring your incentives to weigh the payments more heavily for the later tasks and offering a completion bonus is a proven way to maximize engagement. If you do get a respondent from your CRM who genuinely engages in some of the tasks, but is too busy to complete, you can pay them, honor your “contract” and minimize your outlay.

This gamification ensures that respondents who are slow to engage will still leave the project with a positive experience.

In order to achieve the above outcomes, it’s critical that you or your recruiter actually speak with respondents before inviting them to join. This will allow you to screen out any respondents who might not fit the persona. It also enables you to tell them exactly what is needed of them so they have no excuse later.

Finally, always outline in writing what they need to do in order to receive part or all of their incentives and get them to explicitly opt in to the terms and conditions of your project.

Based on the data we have for B2B versus B2C projects, you need to over recruit.

Whereas in B2C projects we typically see >90% of respondents completing their fieldwork, the metrics in B2B are lower. A successful study in a B2B context will typically have 60-80% of respondents completing.

As a result, we recommend that you over recruit by at least 50% so that the number who engage actively and complete gives you sufficient data for your analysis and reporting.

This is why the advice above on the amount of your incentive and weighting their payment heavily towards completion is so important.

With the lower completion rates, you need to be clever about how you reward respondents so the ones who start and do not complete do not eat into your budget.

With B2C remote ethnographic research projects (or any B2C scenarios where digital qualitative methodologies are employed), the chances are your respondent is quite motivated to complete their tasks and receive the associated incentive.

They will usually take part in break times during the day or in the evenings. Mostly outside the workplace and its associated constraints. As a result of this inherent motivation, completion rates will always be higher.

In B2B however, you are competing with the pressures of their day jobs. Depending on your target personas, the “pressure” will vary e.g. Medical Professionals, Business Owners, Farmers or Senior Executives are extremely busy and as a result, require longer fieldwork durations as the demands of their jobs will always take precedence over your tasks.

For this cohort, you have to be patient and play the long game.

As a result, you need to prepare for the fact that fieldwork will never go as quickly as you want it to. You will have to plan for a longer fieldwork duration so that they have ample time to do your tasks. If the activity you need to complete would take 1 week for example, in reality, you will need to allow 2-3 weeks for the respondents to get through their tasks because they will do it when they have time rather than when you want them to.

When you’re working with B2B respondents (who typically need to complete tasks during their working hours), you will need to quickly build trust with them so that your interactions with them become a dialogue rather than a series of reminders that puts you in the persona of a school teacher chasing homework.

There are a few strategies for this.

The most important is that you introduce yourself to the respondents with a selfie video. This enables them to see that you are a real person who, just like them, is just trying to get your job done. It also enables them to quickly relate to you and dissipates any perception they might have of you as someone in a lab wearing a white coat.

Have some fun with it. Inject your personality. Be authentic. Be real. This will pay dividends when it comes to cajoling them forward to complete their tasks.

Secondly, as soon as they start to upload posts, you need to respond asap. The first 48 hours are critical to building rapport. Respondents need to know someone is listening and that taking part is worth their while. You don’t have to respond within minutes, but for the first few days of your study, be sure to allocate time to check in regularly and respond. Ethnography Platforms that send you desktop notifications whenever there is activity make it easier for you to maintain this engagement.

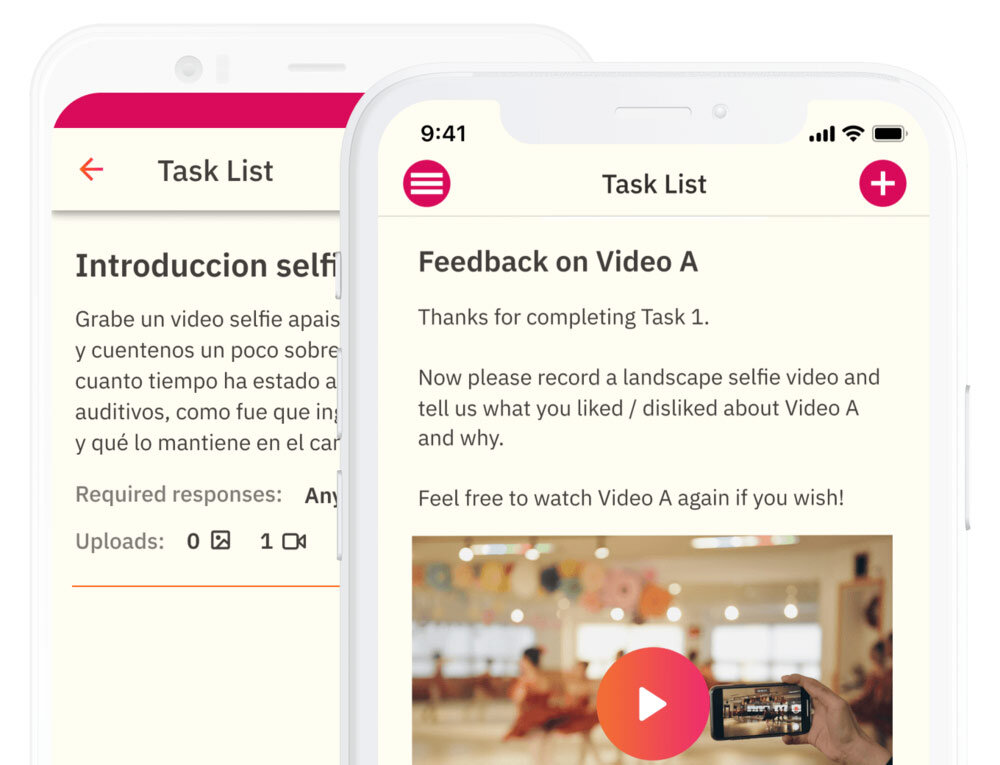

Thank them for taking the time to upload. If you have follow up questions, go ahead and ask. Ethnography Platforms that enable commenting and probing using push notifications are ideal for this. With messaging style push notifications, your interactions are more like text or chat and enable you to quickly establish rapport.

Finally, we highly recommend that you use video in as many tasks as possible, especially if they require a lot of explanation. Instead of respondents scrolling through black and white text, a video from you explaining what the need to do, how and when will cut through more powerfully and improve engagement.

This leads me onto my next point for maximizing engagement.

Notwithstanding my Jerry Maguire point on incentives above, a percentage of your respondents will typically not be in it just for the money. They might be genuine users of your product and are taking part in your project because they care.

If your product or service is still in beta or just launched, the best respondents will genuinely want to help you improve your offering.

Why?

Because if you do, it will improve their lives. It will make them more productive or solve a current pain or help them make more money. It’s extremely rare that customers get to establish a genuine dialogue with the vendor they are invested into.

If you are a User Researcher or Experience Designer who directly influences the product or service roadmap, your users / customers will understand the unique value of this and will openly share their feedback and pain points. Not only are they getting paid to take part, the also get a rare opportunity to guide the feature set and ultimately improve their user experience.

Make your tasks easy and quick and align your tasking with their daily routine as much as possible. Don’t be too rigid on how they need to respond; any engagement is better than none and don’t forget, you can always follow up with a comment and probe asking them to expand or clarify their posts.

The other point to note here is that you need to give the respondents a voice. Keep your tasks open-ended. As mentioned in our Mobile Diary Study post, what you’re searching for here is the unknown unknowns.

If we’re being 100% honest with ourselves, none of us truly understand what really matters to our customers.

So, in every task, give them the freedom to add any additional information or detail on what they feel is important or relevant to them. A simple “feel free to share any additional information or detail which you feel would be helpful to you in relation to this task” can open doors to unmet needs that can massively impact your value proposition.

At the risk of repeating myself, B2B respondents are busy. Their time is valuable. A lot of our clients start out with lots of very specific tasks, programmed in quick succession to answer every question that internal stakeholders pose.

Why are people abandoning after download?

Why aren’t they completing action X on day 1?

Why are our Monthly Active User numbers flatlining?

Why do Y% churn after Z days?

As a result, their instinct is to bombard the respondents with question-dense tasks that they hope will magically shine a light on these human blind spots only to find that the respondents signup up to the project and then do nothing for the first 3-4 days.

This can create a lot of internal pressure on Researchers and Designers – mostly coming from project sponsors who want answers fast.

You need to design your study and manage expectations to avoid this scenario.

It’s not fun to be sitting at your dashboard after 3 days and see tens of uploads when you were expecting hundreds.

There are a number of strategies you can employ to de-risk this.

Set realistic expectations with internal stakeholders. The very fact they are commissioning this research means their analytics are likely not telling them everything they need to know. So, you need to get them to embrace the unknown. Ensure they know that this will take time. Tell them you might not get the answers you need. Tell them to be patient.

Don’t view a lack of engagement as a failure. If anything it’s the essential, real-life data that the business needs to embrace. It’s likely no coincidence that your study to understand the low engagement in the first 3 days of your user onboarding journey also results in low engagement from your research respondents!

The challenge is to understand why. In order to do this, don’t be afraid to pivot your tasking.

If they are not doing what you asked them to do, then clearly (assuming your incentives are realistic and you screened them before inviting them) something is distracting them or keeping them busy doing something else.

If you come across this scenario, then alter your tasking and find out what they are doing when they are not doing your tasks.

Come clean. Ask them what else is going on.

Comment on their first upload. Tell them you notice that they seem too busy to engage and ask them what else is going on. Again, a Digital Ethnography Platform that enables you to alter your tasking based on the data you are gathering will enable you to be agile in this regard.

If they don’t complete task 2 which relates to feedback of their experience on-boarding with your application, create a new task 3 to ask them what else is going on in their work lives this week. Broaden it out. Pivot your focus.

We have had a number of studies recently where we noticed low engagement and scheduled brainstorming sessions with our clients.

We know when engagement is below par. Our software tracks this and alerts our Strategists accordingly.

As a result, we usually recommend “Plan B” tasking either with the same cohort of respondents or with a second wave of respondents.

Again, the reality of this is that you are seeking multiple unknowns here. If you’re engagement is low, treat this as one more unknown and pivot your tasking to find out why.

A quick change in the focus of your tasking will enable you to probe this new data. And remember, no engagement can be rich data. You just need to follow the signal it is sending you.

Finally, a magical one week study will rarely produce the silver bullet you need. Anyone in startups who has read ‘The Hard Thing about Hard Things” by Ben Horowitz will be familiar with the phrase that goes something like this: “there are no silver bullet to fix most problems, you just need a lot of lead bullets”

In a way, B2B user research is the same. It takes iteration. It’s not a one off event. It’s an agile process requiring continuous improvement.

In our opinion, this approach can be executed in two ways:

When designing your project, we recommend that you recruit your respondents in waves or phases. Start with a percentage (25-33%) of your target number of respondents in the first phase. Give them a week to complete their tasks. This gives you time to synthesize and evolve. If the engagement is low, you can probe why the first wave of respondents did not engage and then improve your tasks for the second and subsequent waves based on the learnings of the previous cohort(s).

This data driven, tasking methodology will ensure that you continuously improve your research by iterating based on the data you gather. This is a proven strategy that has worked in multiple B2B projects that we have supported.

It will take extra time, but if you manage expectations internally and design this into your research from the outset, this will quickly begin an internal dialogue in your product design or service design teams that is fuelled by real life, customer feedback rather than internally generated group think hypotheses.

By researching in waves, low engagement on phase 1 will not torpedo your entire project. It merely enables you to disprove your initial hypotheses and amend your tasking to go ahead and research others.

Which leads me onto my second point: think marathon, not sprint.

The journey towards excellence never ends. Research is the same.

Very few product or service design teams magically come up with a eureka that quickly converts into recurring revenues.

Even the rose-tinted, post rationalized stories about founders renting out blow up beds and converting that into a multi-billion dollar business glosses over the years of grind, failure, and iteration that was required to evolve that initial lightbulb into an IPO.

The reality is that innovation is a grind and requires a CONSTANT understanding of the needs, behaviors, and motivations of your users or – better still - your customers!

The only way to continually understand them is to continually engage them.

Your customers will guide you forward – if you engage in a dialogue with them.

WE BELIEVE that great, remote ethnographic research in any B2B context merely starts with a quick sprint and - ideally - should evolve into an on-going process.

The most innovative companies we support conduct remote, ethnographic, B2B research on a longitudinal basis. We have some clients who are entering their 3rd year of research using Indeemo and are increasing their scope year on year.

Like any successful digital product or service, your user research needs to be always on. By engaging as little as 10 respondents per month, you can constantly iterate your B2B research and stay continually tuned in to the needs and experiences of users and customers. It costs less than you might think and the investment could save you a fortune in the long run by building what users need instead of wasting money and time on ‘wouldn’t it be cool if’ features.

In an era where disruption is the norm and the need to innovate is continual, B2B research needs to evolve from an annual luxury budget item to ongoing necessary investment.

Properly understanding your users and customers is a process of continuous improvement: you’ll never be as good at it as you want to be and - with the speed at which trends change nowadays - the results rarely last very long.

Great research requires constantly engaging with your users to better understand them. Staring at logs or mapping Behavior Flows on Google Analytics will only tell you what they are doing and when. It will never tell you the why.

The real why can never be found in metrics or flow charts.

The real why is usually uttered in-the-moment by a customer, in their every day context, while they are actually engaging with your product or service.

You know it when you hear it. It instantly resonates across the research and design team.

The problem is, very few brands have the time or the budget to meet their users or customers in their every day context to witness and experience these moments. Furthermore, users rarely behave normally in a UX lab environment with a researcher looking over their shoulder.

That’s why you need to add remote Mobile Ethnography to your research toolkit.

With remote Mobile Ethnography, you can engage your customers in their everyday context at a time that suits them. Leveraging the power of video or screen recording, you get to remotely record what your customers experience when they are interacting with and using your product or service (and with no one looking over their shoulders).

The rich, spontaneous, in the moment feedback that Mobile Ethnography captures, will help you shine a light on those digital blind spots and truly bring your B2B customers to life.

As a consequence, you should clearly outline the purpose of the research. Tell them what you are hoping to achieve and why. Tell them why their input matters. Explain how their feedback will have impact. Explain that they have a chance to guide the roadmap.

This will massively improve engagement and completion rates. The more they understand the purpose of each task, the more active and engaged they will be for you.

Make your tasks relevant.

This leads me into task design.

Respondents in B2B Ethnography projects are busy. It’s not like they are going to be sitting at home on their sofa telling you what they are watching now or explaining why they are ordering take out on a Tuesday evening.

They will most likely be at work or trying to fit you in during their working day. As a result, you’re eating into their time. You need to ensure they know why it matters. This goes back to my point on purpose above. They need to believe that their posts will make a difference and understand how.

The best way to design for this is to design your tasks so that they are cognizant of the context in which your respondents will be posting.

If they are doing this during the day, make the tasks brief and easy to respond to. If there might be concerns about recording video in the workplace, ask them to post photos with captions instead.

If you’re wondering what applications or technologies they use throughout the day, ask them to take photos or screenshots instead of writing long notes. Screenshots are extremely rich in data: timestamp, applications they are using, what they are doing etc.

Tag: B2B Market Research

Learn more

Blog Recommendation

Case Study Recommendation

If you’re planning a B2B user research project and are considering a remote ethnographic research or a diary study approach, please get in touch.

We can quickly point you in the right direction and share some additional strategies that will help you put a methodology in place to get the results you need.

We’re looking forward to speaking with you.

Learn how Mobile Ethnography can supplement your research projects and generate richer contextual insights for your brands.